when does current estate tax exemption sunset

Starting January 1 2026 the exemption will return to 5 million adjusted for inflation. The conversation often begins with a question from a client such as I understand that the estate tax exclusion amount is very high under current tax law but that it is scheduled to revert back to much lower levels in 2026 when the current limits sunset.

What Happened To The Expected Year End Estate Tax Changes

Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025.

. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. The Tax Cuts and Jobs Act TCJA or Act makes substantial changes to the Internal Revenue Code. While it is possible that Congress could vote to extend them we need to assume at this time that the increased exemptions will go back to their previous levels.

Estate Tax Exemption Expiration. The current 1206 million estate tax exemption annually adjusted for inflation is set to roll back to pre-2018 amounts in 2026. A dies in 2026.

29 2021 President Biden presented a framework for a modified bill that eliminated this change leaving the current law to sunset in 2025. Under the current tax law the higher estate and gift tax exemption will sunset on December 31 2025. You may recall that the 2017 Republican tax reform legislation roughly doubled the estate and gift tax exemption.

Even if the BEA is lower that year As estate can still base its estate tax calculation on the higher 9. The exemption amount would therefore be approximately. Additionally there are four tax rates for estates and trusts.

Before the Estate Tax Exclusion Sunsets in 2026. Unless otherwise noted the provisions discussed below. The current estate tax exemption is.

The sunset provision is important to anyone who may have already used up the old estate and gift tax exemption. For an explanation of why this. A uses 9 million of the available BEA to reduce the gift tax to zero.

1 Any funds after that will be taxed as they pass. And to find the amount due the fair market values of all the decedents assets as of death are added up. It is scheduled to sunset at the beginning of 2026.

With inflation this may land somewhere between 6 million and 7 million. But then on Oct. Standard deduction starting in 2018 was 24000 for married persons filing jointly 18000.

Key estate tax figures for 2022 Unified estate and gift tax exemption 1206 millionindividual Maximum tax rate 40 Annual gifting exemption 16000individual. The law also changed standard deduction. This scenario creates a having your cake and eating it too option between now and January 1 2026 when the doubling of the estate and gift tax exemption will sunset allowing a family to act now instead of waiting.

The estate-tax exemption rose to 1158 million in 2020 180000 higher than the year before to account for inflation. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be. The annual tax exemption will then revert back to the 2017 level albeit adjusted for inflation.

Under the new tax law you can give away just over 11 million in gifts over your lifetime. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. In 2018 when the BEA is 1118 million A makes a taxable gift of 9 million.

Thats because the increase in the exemption is due to sunset as of January 1 2026 meaning that estate gift and generation-skipping transfer tax exemptions will return to their pre-2018 levels. This higher exemption is going to sunset at the end of 2025 falling back to 5 million. 1 2026 Sunset Exemption per individual 11700000 3500000.

This means that if Congress does not take action before then federal gift and estate tax law will generally revert to rules in place in 2017. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset. Accordingly many of the TCJA provisions are temporary.

1600000 18000000 13000000 Tax Rate 40 Progressive 40 Estate Tax Due. New law to sunset in 2026. The estate tax is a tax on an individuals right to transfer property upon your death.

Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021 should it disappear. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. There is an interesting twist to the new tax law.

10 24 35 and 37. By Megan Russell on September 3 2020. This means starting in 2019 people are permitted to pass on tax-free 114 million from their estate and gifts they give before their death.

And estate taxes will sunset after 2025. Currently there are seven different tax rates for individuals the lowest being 10 and the highest falling from 396 to 37. The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022.

January 11 2018. In order to comply with certain budgetary constraints the TCJA contains a sunset or an expiration date for many of its provisions.

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Pin On Retirement Info Destinations

What S Happening With The U S Estate And Gift Tax O Sullivan Estate Lawyers Toronto On

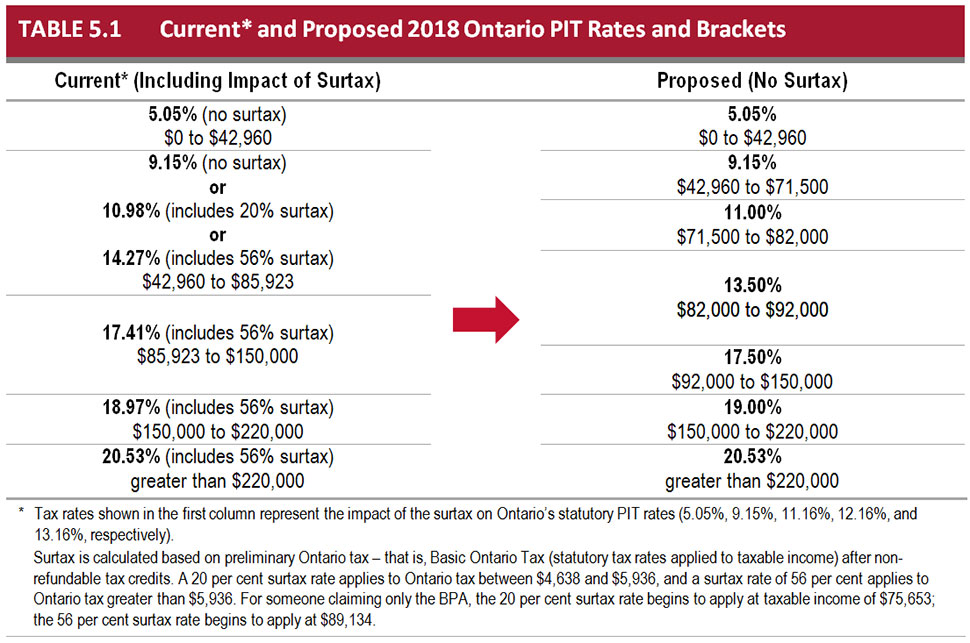

Ontario Budget 2018 2019 Tax Measures Logan Katz Llp

U S Estate Tax Exposure For Canadian Residents Who Are Not U S Citizens Manulife Investment Management

Will The Lifetime Exemption Sunset On January 1 2026 Agency One